If you have done any significant saving you may feel like you are on top of the world…… ok but really retirement planning has often been compared to climbing a mountain.

The climb up is likened to the accumulation of funds and the climb down has been compared to the distribution of that money. (You take the money you saved and you try to turn it into income over the span of your retirement

Statistic’s show that more people die coming down the mountain than climbing up it. Enter Sequence of Return Risk

This is the risk that you will experience negative returns right before or right after you retire. This risk can have a devastating effect on your retirement

Lets look at an example

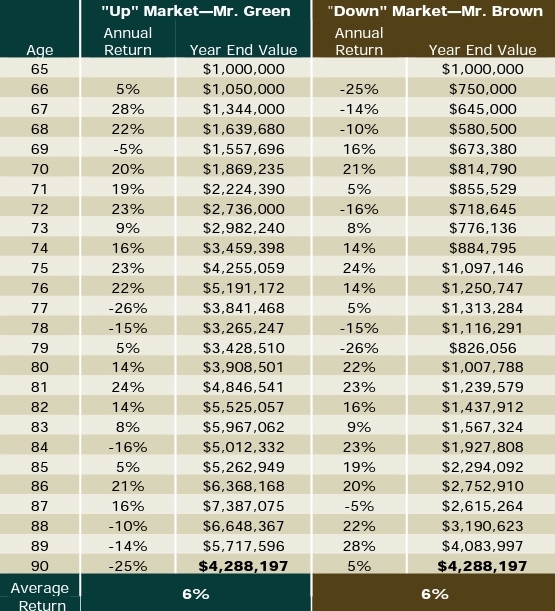

Notice that the rates of return although not in the same order average out to the same amount. The order in which you get these returns do not matter. This changes completely when you start withdrawing money.

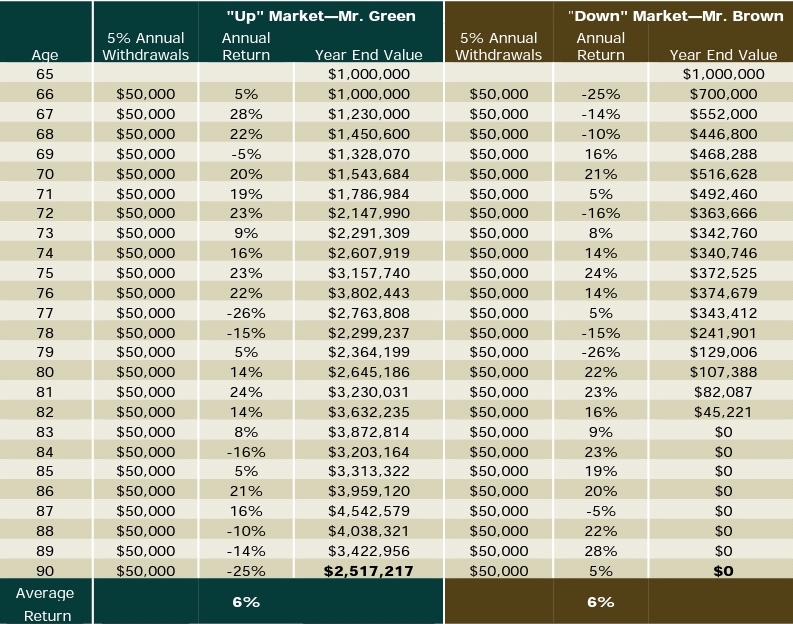

Imagine you are in retirement, you have worked hard to save your money and you decide that you will withdraw 50k a year to replace your income. In both examples you average 6%. The only difference—- the order in which you get the returns.

If you are Mr.Green ended with more money than you started.

But if you are Mr. Brown you are out of money by 82.

Why the difference? Client A had negative returns in the first few years of retirement and was never able to recover

The reason this risk is so dangerous is because we have no control over what the market will do.

Conclusion:

How To Protect Against Sequence of Return Risk

- Guarantee Some Off Your Income

The more guaranteed income you have the less you will need to withdraw from your stock market assets. The less you need to withdraw from your stock market assets when they are down then the less sequence of return risk will have a negative effect on your retirement.

2. Create Income From Non-Stock Market Sources

A popular strategy to manage sequence of returns risk is to create income from non-market sources. If a portion of your savings is growing outside of the market then you can use it for income when the market is down. This will allow your assets in the market to recover.

Conclusion:

To have a successful retirement requires more than just accumulating money (climbing up the mountain). You also need a plan to distribute your money safely so that you can get back down the mountain again. We help our clients create an income plan that they can be confident will last. If you would like to discuss feel free to set an appointment below.

Want to Get Your Retirement in Order

Subscribe for financial content that can help!

Schedule a free strategy session

Schedule a One-on-One Phone Meeting directly with me. The STRATEGY SESSION IS COMPLETELY FREE! Ask any retirement, Financial Planning, and Insurance questions you like.