Blog

By Jason Canady Ok so imagine, you are in retirement and everything went right. You have worked hard you have 1 million dollars saved up to replace your paycheck

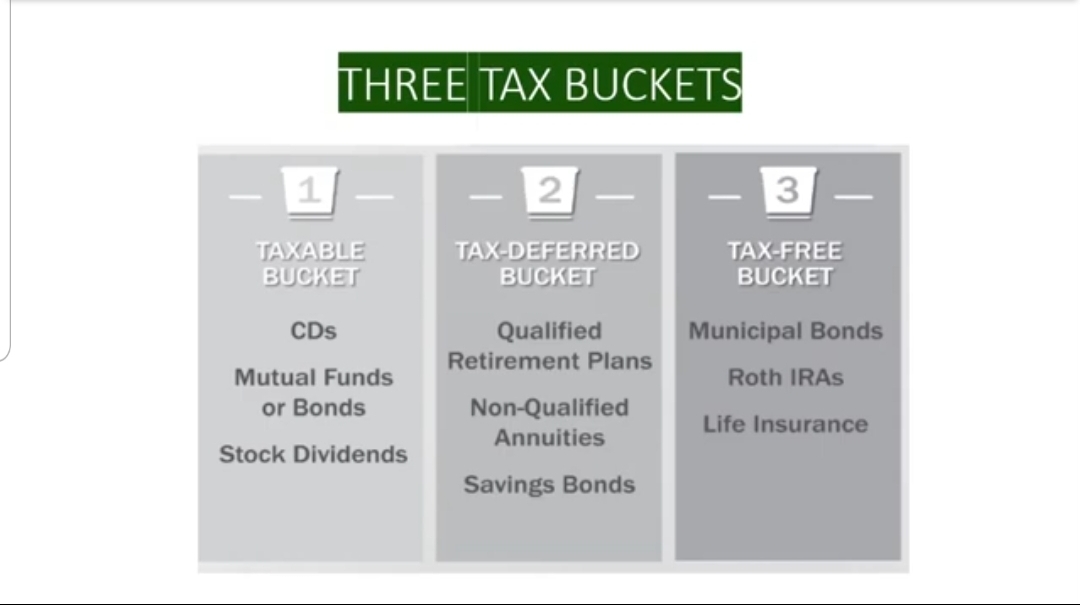

The average person according to yahoo finance will pay over $500,000 in taxes over their lifetime. 🤯 If it was possible to pay zero taxes in retirement would you

What would happen to your retirement income if the market went down 📉 when you needed your money the most(in retirement)? How would that effect your income? More importantly

Most savers have some money in a 401K or a 403B. But is it possible to put too much money into your 401k🤔? What if it could cost you

If there was an asset where you could grow your money without market risk and still get competitive tax free growth would you want to know. We discuss the

If you want to protect your retirement it is important to have a strategy for long-term care. What Is Long Term Care Risk? It is the risk that you

If you have done any significant saving you may feel like you are on top of the world…… ok but really retirement planning has often been compared to climbing

How much of your nest egg can you spend each year without running out of money in retirement? Most people would answer this way; if the market averages 7%

Life Insurance is one of the most confusing topics in Financial Planning but it is a necessary part of the process. How Do I know which type of

Fidelity Investments, one of the world’s largest asset managers with $7.9 trillion in assets under administration, has seen Roth IRA conversions surge 76% in the first quarter from a

Key Focus of Article: The list below highlights some ways to save more money. Pick out a few that speak to you and apply them. Even using just a

The Roth IRA is one of the most popular retirement accounts on the market What is a Roth IRA and why should you consider one? A Roth IRA is