By Jason Canady

Ok so imagine, you are in retirement and everything went right. You have worked hard you have 1 million dollars saved up to replace your paycheck when you stop working. Great right!

Wrong!!!!

You don’t have 1 million because your business partner( uncle Sam has a permanent lien on your account) You have to pay taxes every time you touch your savings.

A lot can go wrong if you don’t include tax planning when you prepare for retirement. Deciding now whether you want to pay taxes in retirement or not could save you thousands.

We Highlight below 4 issues that could arise if no tax planning is done.

- You could be subject to Potential Tax Increases.

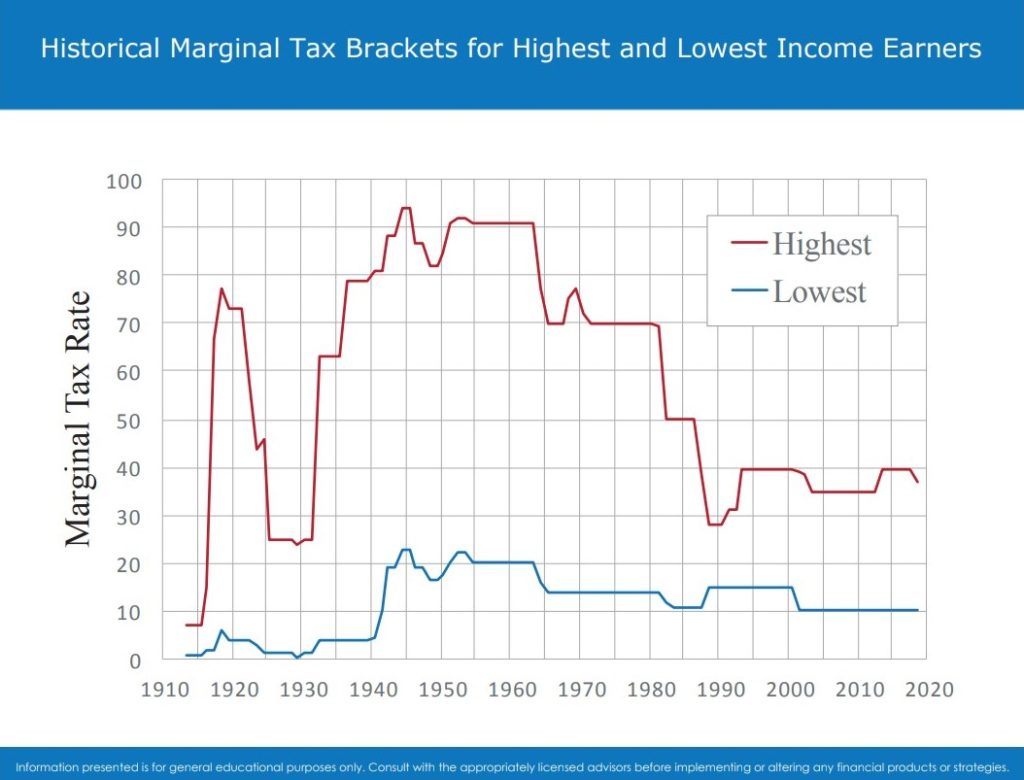

It’s important to remember that whatever tax rates we have now, they are not guaranteed. They can change. In fact, take a look at this historical chart,

In 1945 the highest tax rates were 94%. Really throughout most of history taxes have been higher than they are now.

Also, when you realize that the government has $27 trillion dollars of unpaid debt and over $100 trillion dollars in unfunded liabilities (these are promises they have made that they have not kept yet like social security) it’s easy to see why many economists believe that taxes are going to go up.

“Main Point: Each one of us needs to decide now much of our money we want to be taxed in retirement and how much we want to be tax free”

2. A surcharge could be added to your Medicare.

3. Up to 85% of your social security could be taxable

4. An emergency requiring that you withdraw a larger portion of your retirement funds would push you into a higher tax bracket and cause you to pay more in taxes.

We will dive deeper into this in the video below

These are just some of the reasons a person would want to structure their retirement in a way that they don’t have to pay taxes in retirement . Getting to this position does not happen by accident. It requires proactive planning.

We do this everyday for clients feel free to reach out.