If you want to protect your retirement it is important to have a strategy for long-term care.

What Is Long Term Care Risk?

It is the risk that you or your mate would be required to spend down your assets because of one or both mates needing the care of a nurse either at home or in a facility. 7 out of 10 people will require long term care in their lifetime.

How Much Can Long Term Care Cost

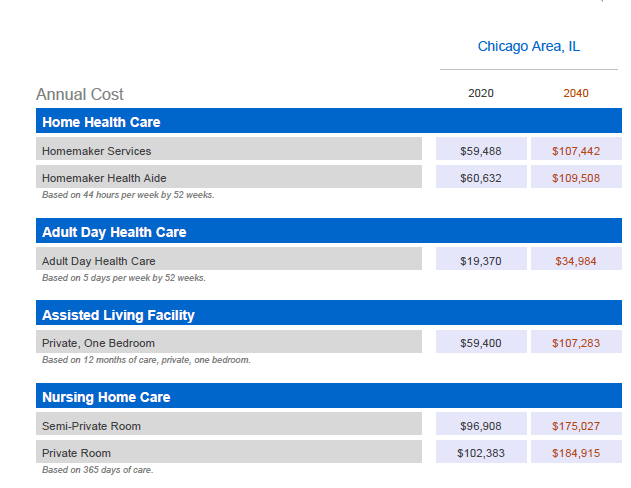

GENWORTH publishes a study every year, that reveals the average and projected cost of care. The most recent study shows just how expensive it can be. I have attached it below. Care can range from $20,000 to $102,000 per year. This type of expense in retirement can decimate your retirement.

Case Study

To illustrate why having a plan for this is so important.

Let us look at an example.

Let us look at a family John & Mary that has $500,000 saved up for retirement.

A year into retirement John gets sick, and he must go into a nursing home. Because they have done a good job saving, they do not qualify for Medicaid. So now John is required to spend down all of his savings to 109,560 as of 2021 and relinquish all of his income including his pension all the way down to $1073.00 a month just to cover his care.

Try to imagine what that would be like for Mary and John. If they are required to spend down their assets where will they get the income to support their lifestyle? If John passes away because of his heath problems where will Mary get income from in retirement? What emotional toll would the financial stress of this situation have on both John, Mary, and any extended family that may try to assist?

What are My Options?

- You can buy regular long-term care insurance.

This is probably the type of long-term care insurance that people dislike the most. If you Google long-term care insurance, you probably hear some stories about how people started paying one amount and it got too expensive. Include google search

That is because the payments you make to the company are not guaranteed. Those payments can change based on how profitable the insurance company you choose is doing during a certain year. This type of plan can get expensive if those premiums keep going up.

Another reason that people may hesitate to buy this type of insurance, is that it is a use it or lose it proposition. If you entered a long-term care facility, they would cut you a check while you are there, based on the terms you set up when you bought it. However, if you do not go into a long-term care facility, then you do not get anything. Imagine, you spend in two, three, four, five, $6,000 a year and you do not get sick. You die peacefully in your sleep and all that money is gone.

Fortunately, because the insurance industry continues to advance that is not the only option.

- You can use a portion of your money to purchase what’s called Asset based long-term care.

Here is the way it works. You can either make multiple payments into the policy, or you can take a portion of your assets and put it into the policy. Let us use an example. Let us say you take $150k, you put it into the policy. Here is how it will work.

After six years. You get back the $150k at any time you need it.

Now, if you die Instead of just getting $150k back, you get $200,000 back.

If you get sick and need long term care, they will take the $150,000 you gave them and add another $450,000 on top of that and give you $600,000 of long-term care insurance.

You can see how this would be a more desirable option for many because in now situation do they lose their money that they placed in this policy.

3.You can buy Life Insurance with a Long-term care Benefit.

For example, a client might currently have $500,000 worth of life insurance. The Insurance Company will give you $250,000 of that money If you ever must go into a nursing home. However, you must make sure you have that option/rider in your policy. Otherwise, you cannot use it.

Conclusion:

Really, regardless of what option a person chooses, long-term care is not something you can ignore. In fact, your retirement plan is not complete. It is not whole, if you do not have a plan for long-term care. The the good news is that with all the options that exist today, just about anyone can formulate a plan or a strategy so that if a long-term care event does happen, their retirement will remain intact.

Want to Get Your Retirement in Order

Subscribe for financial content that can help!

Schedule a free strategy session

Schedule a One-on-One Phone Meeting directly with me. The STRATEGY SESSION IS COMPLETELY FREE! Ask any retirement, Financial Planning, and Insurance questions you like.